Fixed Deposit vs Recurring Deposit : What's The Difference?

Fixed Deposit and Recurring Deposit are popular investment options in India. They are risk-free investments and offer decent returns. But how do you choose between the two? Let us understand the features, benefits and differences between Fixed Deposit and Recurring Deposit in detail.

What is a Fixed Deposit?:

- Fixed Deposit is an investment scheme provided by banks where you invest a fixed amount for a specific period at a fixed rate of interest. Typically, the term of an FD ranges between 7 days to 10 years. On maturity, you will get your original sum or the principal back along with interest. The interest on the amount will be credited to the investor's account on a monthly or a quarterly basis.

What is a Recurring Deposit?

- A recurring deposit is a type of term deposit where customers with a consistent source of income deposit a set amount of money on a monthly basis. RD tenure ranges from 6 months to 10 months (generally). The amount on recurring deposits must be deposited every month for a set period of time. After maturity, the principal amount is returned along with interest earned. The interest on the recurring deposit can be received either at regular intervals or you can choose to receive it at the time of maturity. To calculate the maturity amount (the total of deposits made + interest earned),you can use RD calculator. It is best suited for salaried people and those with a low annual income.

Common Features Of Fixed Deposits and Recurring Deposits

- Guaranteed Returns : Guaranteed Returns: Guaranteed returns at the end of the tenure. Investor can use a specific FD or RD calculator to see the returns he will receive on investing a particular sum of money for a particular period of time. Your investment is secure irrespective of market situations.

- Pre-mature withdrawal : You can withdraw from an FD or RD before maturity. In the case of Axis Bank, up to 25% of the principal amount can be withdrawn before maturity without penalty. But subsequent withdrawals or if the amount is more than 25% of the principal premature penalty will apply.

- Taxability :When it comes to taxability, the interest income for both fixed and recurring deposits is taxable at source (TDS) if it exceeds Rs. 40,000 in a financial year.You have to pay income tax if the interest earned is more than Rs. 10,000 in a financial year. For senior citizens, the TDS limit is Rs. 50,000.

- Loan against FD : Instead of taking out an unsecured loan and paying a higher interest rate, you can avail a loan against your fixed deposit and recurring deposit.An FD loan is helpful in case of financial emergencies.

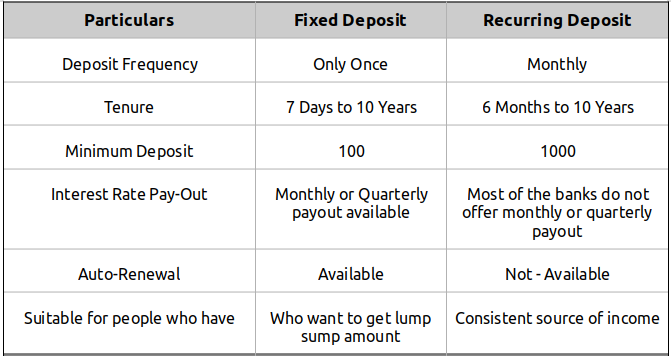

- While the interest rate and benefits are the same for FDs and RDs, there are some differences in terms of the manner of investment, minimum investment amount, tenure, etc. The significant diffrence between these two investments is that you must invest a lump sum amount to book an FD while for recurring deposits, regular payments have to be made.

- Fixed Deposit : It is good choice for those who want to get lump sum amount. It is also a good option for someone looking for regular cash inflow, as you can choose monthly or quarterly pay-out.Consider you have a lump sum amount. You can invest in an FD to earn a fixed rate of interest, which can be reinvested for the benefit of compounding. This can help you maximise your returns.

- Recurring Deposit : It is best suited for those who have a consistent source of income. This will help you to plan some future expenses.

Differences Between Fixed Deposits and Recurring Deposits